This can be confusing, but we’ve tried our best to show you how simple these processes can actually be. We’ve tried to put this pack together in a way which caters to a broad scope of accounting needs. At the end of your fiscal classified balance sheet financial accounting year, you will be looking at this account again to determine what receivables you will need to send to collections or write off for a deduction. Managing finances doesn’t have to be the bane of your professional existence.

These checks are used when you need to guarantee that funds are available for payment. They’re ideal for large purchases, such as a car or a house down payment when a credit or debit card payment wouldn’t be practical. A second chance account is usually designed to help you avoid overdrawing your account. After a period of meeting the bank's expectations, you may even be able to transition to a traditional account with better terms. As you grow, hire a small accounting team to help you with the accounting procedures and financial reporting.

It will show the customers that you care about their needs and understand their situation very well. A cloud-based solution that makes it easy for accounting firms to manage client work, collaborate with staff, and hit their deadlines. Plus, familiarise yourself with the Making Tax Digital (MTD) government initiative to streamline the tax process. Right now, only VAT registered businesses are required to follow these processes. It’s important to have a system for creating and sending invoices to your clients. Plus, you must keep these invoices in your records using an invoice numbering system.

If so, check out our article on how to understand financial accounting. Sending invoices notifies your customers about a payment, but you’ll still need to find a way to accept that payment. This budget will also take startup costs https://www.personal-accounting.org/what-are-freight-rates-freight-rates-explained/ into account and help you determine what sales will allow you to reach profitability. You can choose to record training videos for navigating through the dashboard, accessing relevant features, and customizing their interface.

Review your current inventory to determine the value of items not sold. Any write-down of inventory translates to a deduction on your year-end taxes. If you do not write down unsellable inventory, you are overstating your inventory balance and paying additional taxes that you don’t owe. Without a due date, you will have more trouble forecasting revenue for the month. To make sure you get paid on time, always use an invoice template the contains the right details such as payment terms, itemized charges, and your payment address. You may choose to use a payroll service like the one we offer at Addition Financial to help you manage your payroll taxes and avoid problems with the IRS.

You can also use our free sales tax calculator to help calculate sales tax. Keep a record of each of your vendors that includes billing dates, amounts due, and payment https://www.kelleysbookkeeping.com/ due dates. If vendors offer discounts for early payment, you may want to take advantage. This practice can help you avoid the issue of unauthorized overtime pay.

This is a good practice, particularly if a customer has past due invoices. Try using report builder software to create your accounting reports more efficiently and reduce human error. Plus, with a click of a button, you have a beautiful report ready to share with internal and external stakeholders. The frequency of employee reimbursements would depend on the frequency of transactions your employees make on your behalf.

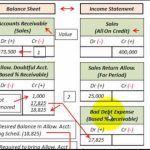

They are an asset you’ll recognize as expenses in different accounting periods. With account reconciliations, you’ll spot mistakes in your financial data and fraudulent transactions (if any!). Review your accounts receivable to see if your customers are paying within the agreed credit term. Check if you’ve posted debit and credit entries accurately for all the transactions. Next, review if you’ve posted your journal entries correctly into your general ledger.

Whether you have a seasoned or new business, brick and mortar or eCommerce, there are numerous monthly accounting tasks you need to handle. Managing your cash flow is critical, especially the first year of your business. Forecasting how much cash you will need in the coming weeks and months will help you reserve enough money to pay bills, including your employees and suppliers. Forecasting how much cash you will need in the coming weeks and months will help you reserve enough money to pay bills and your employees and suppliers. Plus, you can make more informed business decisions about how to spend your cash. There are a few business accounting basics you should understand to ensure your business operations run smoothly.

Start by collecting all your client’s financial data, including past accounting software files, spreadsheets, bank statements, invoices, and expenses. Ensure all of their financial data is accurately migrated or converted to your client’s QuickBooks Online account. As a self-employed small business owner, you’re responsible for making quarterly income tax payments. The process of calculating your estimated tax obligations starts by estimating your anticipated adjusted gross income, your deductions, and any credits you may have received during the year. While you will want to calculate all of those figures exactly, you can use last year’s income figures as a guide. Aged receivables are payments on invoices that are overdue from customers.